Commodity Trader (ms) app for iPhone and iPad

Developer: missingSTEP

First release : 10 Apr 2014

App size: 9.14 Mb

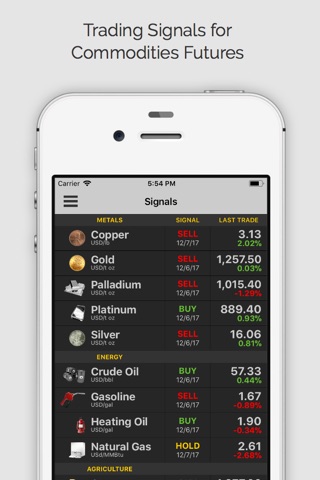

Commodity Trader is a tool for investors, traders, and industrialists who take positions in the worldwide commodity futures markets in the segments including metals, energy, and agriculture. Based on a complex mathematical model, this tool provides trading signals for commodity futures contracts.

SECTIONS

- Trading Signals (can be accessed via in-app purchase)

- Commodity Charts

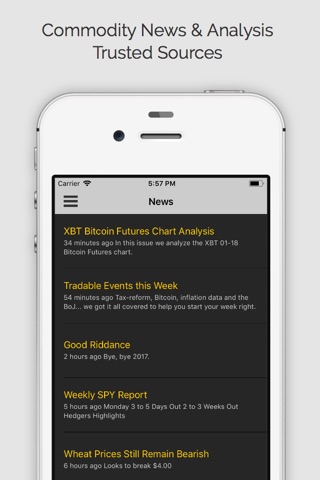

- Commodity News (can be accessed via in-app purchase)

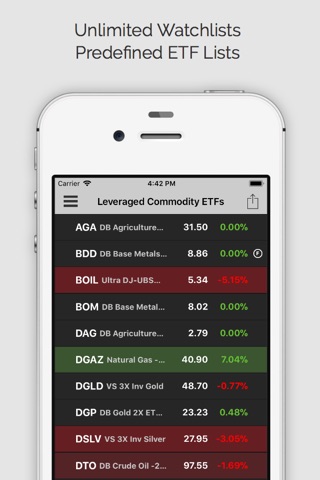

- Commodity ETFs & Watchlist

Featured Commodity Futures Contracts

Gold, Silver, Copper, Platinum, Palladium, Crude oil, Heating oil, Gasoline, Natural gas, Corn, Wheat, Soybean, Lean hogs, Live cattle, Cotton No.2, Cocoa, Coffee ‘C’, Sugar #11, Lumber

Other Features

- Watchlists

- Predefined ETF lists

- Discussion pages

- Price alerts

How does it work?

Commodity Trader examines historical data of selected commodities and constructs correlation/dispersion and volatility maps. A complex computerized mathematical model continuously checks prices and compares them to these maps by using various algorithms. If the price of a commodity future contract falls below its character map, it generates a buy signal. If on the other hand the price goes above its character map, the tool generates a sell signal. As these anomalies occur, trading and significant profit opportunities arise.

Commodity Trader is especially designed for:

- Intermediate to advanced level traders who are familiar with the concepts of trading on margin, margin maintenance requirements, short-selling, and characteristics of momentum trading

- Professional asset managers who manage commodity related funds

- Professional commodity traders who possess extensive level of knowledge in risks associated with commodity trading

- Industrialists who either produce commodities (revenue generator) or use commodities as raw materials (cost management) for their manufacturing of products and actively take positions to hedge operational risks

- Researchers who analyze commodities markets

Latest reviews of Commodity Trader (ms) app for iPhone and iPad

Seems to be dependable and as accurate as any other commodity apps.

We can trust

Was a great app until you had to sign up for an account... Delete...

Cant do much thing to evaluate the value without buying... :(

This App is amazing and very informative. Thank you